![Empty Mansions]()

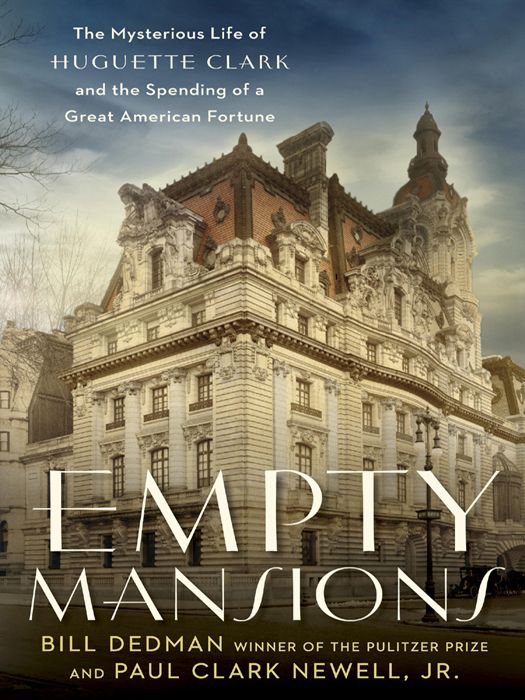

Empty Mansions

the two men would not profit in any way from the estate. Nevertheless, Clarelater said, she was reluctant to join the family’s challenge, not finding enough evidence for her to swear that her great-aunt’s will was invalid, that Huguette was mentally incompetent. “I do in fact believe,” Clare said, “that my aunt well understood how she was dividing up her wealth, and that her final will represents her own intentions.”

She continued, “In my view, it would be a terrible waste for the relatives to drain the Bellosguardo Foundation to the point of extinction and to deny the Corcoran its Water Lilies. More than half the wealth Aunt Huguette left to charities would now have to go toward paying huge estate taxes and the staggering commission for the relatives’ own lawyer. The gain for any single member of the family would be small compared with the loss for these charities supporting the arts.”

She concluded, “Altogether, I find the prospect of challenging my Aunt Huguette’s will to be disrespectful of what could be her true wishes, an impolite act not in accordance with my values.”

THE TAX BILL

H UGUETTE DIED owing the IRS $82 million in gift taxes, with the bill rising $9,000 per day from penalties and interest.

The tax bill was discovered because the judge decided that Bock and Kamsler needed a chaperone. In light of all the news coverage, the judge declined to let them administer Huguette’s estate alone. The judge appointed a third financial watchdog, an official known as the New York County public administrator.That administrator’s attorneys soon discovered that Huguette had not paid millions in gift taxes on her spree of generosity. One-quarter of her estate could be eaten up by the bill from the Internal Revenue Service.

Taxes on gifts are paid by the giver, not the recipient.No gift tax returns were filed for Huguette from 1997 through 2003, during which time she gave approximately $56 million in gifts. Some of her gifts were subject to another tax as well, the generation-skipping transfer tax, which must be paid when the recipient is much younger than the donor. The total due in taxes for all years was about $34 million, but that was just the beginning. Add on penalties of $16 million and interest of $32 million, for a total liability of $82 million.

Kamsler was responsible for the finances and was paid $5,000 a month for his accounting work. Records show that he warned Huguette repeatedly to stop making gifts because she didn’t have enough liquid assets to cover the gift taxes. He never mentioned the generation-skipping tax, which came into play when she gave money to Hadassah and some others. The public administrator’s lawyers also found that Kamsler prepared false gift tax returns claiming that the previous returns had been filed, and he lied to the IRS by claiming he didn’t know about the $5 million given to Hadassah.

Bock said that when notices from the IRS came to him, he sent them to Kamsler, but Bock also had responsibility for taxes. His monthly invoices for $15,000 listed his duties, including filing estate and gift tax returns. When Huguette paid $1.85 million for the security system on the West Bank, a gift solicited by Bock in 2000, he did not tell her that she already owed more than $5 million in taxes for gifts given that year and that she had not filed gift tax returns from 1997 to 1999. Bock said he accepted Kamsler’s assurances that he had taken care of any late filings.

WHITTLING DOWN A FORTUNE

Huguette’s estate was worth about $308 million before the payment of taxes. Following is a listing of her assets and how they were to be distributed according to her will.

Her largest assets:

• $84.5 million for Bellosguardo in Santa Barbara.

• $54.5 million for three apartments at 907 Fifth Ave., New York City.

• $14.3 million for Le Beau Château in New Canaan, Connecticut.

• $79.3 million in stocks, bonds, cash, and trusts, including $4 million in her checking accounts and $4,039 in unclaimed funds received from the State of New York.

• $75.4 million in personal property, including her $25 million Monet Water Lilies painting, $14.2 million in jewelry and furniture, $1.7 million in dolls and castles, and $34.5 million in paintings, books, and other property.

That $308 million would be whittled down pretty quickly. Here’s an estimate of how it would get carved up if the will were carried out as Huguette signed it.

• $7.9

Weitere Kostenlose Bücher