![Empty Mansions]()

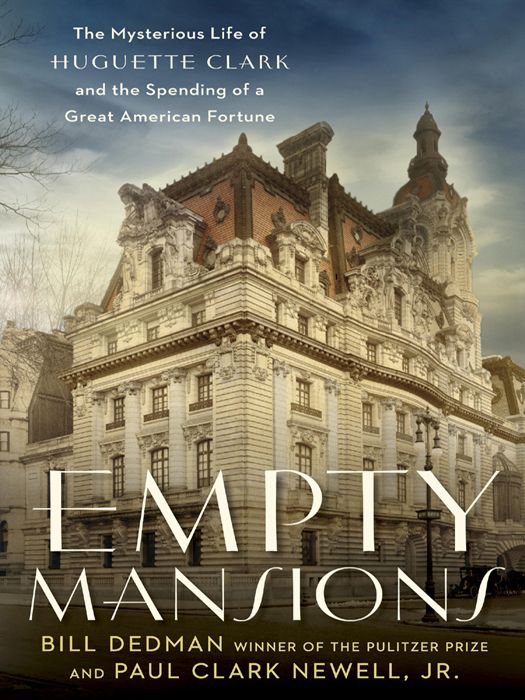

Empty Mansions

million to pay off a line of credit at JPMorgan Chase.

• $66.3 million for gift taxes, assuming the public administrator was able to reach a settlement with the IRS to eliminate the penalties.

• $6.3 million in executor commissions for attorney Bock and accountant Kamsler.

• $3 million in estate operating expenses for about three years while in court.

• $21 million estimated legal fees for attorneys representing thepublic administrator, and attorneys for the presenters of the will (attorney Bock and accountant Kamsler), and others.

• $23.6 million in estate taxes.

• $5.4 million in generation-skipping transfer taxes. (A bite comes out of the bequests to younger beneficiaries.)

That would leave about $175 million after taxes to distribute to beneficiaries. If Huguette’s last will were upheld, it would be paid out roughly like this:

• Bellosguardo Foundation: $123,751,465 † (70.94 percent)

• Corcoran Gallery of Art: $25,000,000 (14.33 percent)

• Hadassah Peri, nurse: $15,287,554 ‡ (8.76 percent)

• Wanda Styka, goddaughter: $7,897,430 (4.53 percent)

• Beth Israel Medical Center: $1,000,000 (0.57 percent)

• Wally Bock, attorney: $500,000 (0.29 percent)

• Christopher Sattler, assistant: $370,370 (0.21 percent)

• Irving Kamsler, accountant: $370,370 (0.21 percent)

• John Douglas, manager, Bellosguardo: $162,924 (0.09 percent)

• Henry Singman, doctor: $100,000 (0.06 percent)

• Tony Ruggiero, manager, Le Beau Château: $12,444 (0.01 percent)

When Kamsler was called to give a sworn deposition in the estate case, he wouldn’t answer questions about the gift taxes, exercising hisFifth Amendment right against self-incrimination 192 times. He did say that he never lied or deceived Huguette and never stole from her.

Bock and Kamsler faced more trouble. The public administrator filed malpractice claims against them on behalf of Huguette’s estate, and the judge suspended them as preliminary executors. Their $6 million in fees, the payday they had toasted that day in the restaurant in 2005, was gone.

• • •

The public administrator also aggressively went after the gifts themselves, demanding the return of more than $40 million to Huguette’s estate. More than half of that amount had been given to Hadassah. If the administrator were successful, that also would reduce the gift tax bill: If there was no gift, there was no tax due. The administrator did not seek to recover gifts given to Madame Pierre and her family, Wanda Styka, or Chris Sattler, focusing on those whose financial or medical roles put them in confidential relationships. § Under New York law, any gift to a person in a confidential relationship is presumed to be the result of undue influence. The recipient has the burden of establishing that the gift was proper. The public administrator’s office argued that Huguette’s close circle of caregivers used their positions to exert influence and control over her, in effect looting her assets.

The problems for the public administrator were that most of these gifts were a long time ago, and Huguette had made the gifts herself, relentlessly writing the checks until her eyesight gave out. Defending Huguette’s will, Bock’s attorney, John D. Dadakis, said the legal challenge was an insult to Huguette. “To suggest that these gifts were not from Mrs. Clark’s generous heart is to denigrate the person who gave these gifts, as well as the recipients who cared for her with their love,” Dadakis wrote. “All of the records reflect that Mrs. Clark actively enjoyed her generosity and fully understood what she was giving.”

JUST THROWING MONEY AWAY

L IKE A CONFIDENT TEENAGER at a carnival throwing three baseballs to knock over a tower of milk bottles and win a stuffed panda, the Clark family had three chances to win Huguette’s fortune.

First, if the family could prove that both wills had not been legally signed and executed, they would inherit everything. If the family knocked out the last will, they could then go to work on the earlier will, which no one seemed to be able to find an original copy of anyway. Photocopies of wills are not often admitted. Even if the family got the later will thrown out but failed to throw out the earlier one, it still left nearly everything to the family except the $5 million to Hadassah.

The signing ceremony had certainly been faulty, especially considering that a challenge to the will by

Weitere Kostenlose Bücher