![Empty Mansions]()

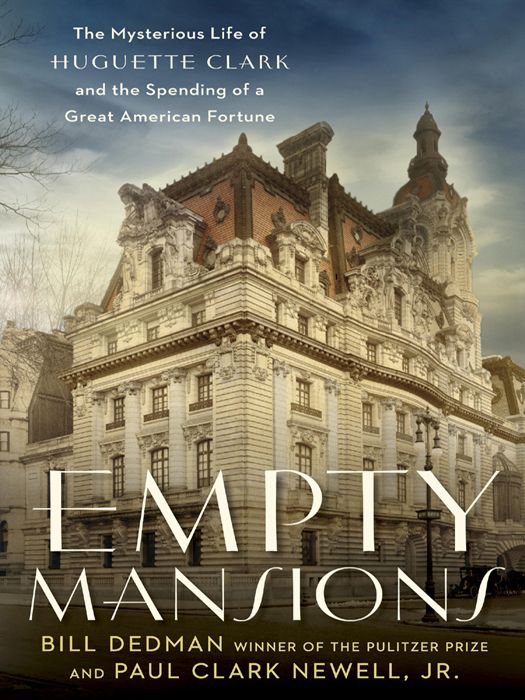

Empty Mansions

the thank-you card in her bedroom, tucked away in her hosiery drawer, and she’s not going to tell anyone who sent it.

AN ABSOLUTELY RIDICULOUS SITUATION

T HOUGH HE NEVER SAW his client’s face, attorney Don Wallace would scold her from time to time via letters and phone calls.

“Every year since you have been in the hospital, now for almost three years,” he wrote to Huguette in September 1994, “your total expenses for each year have exceeded your total income for each year. This is an absolutely ridiculous situation.” He cited her unoccupied three apartments, her Connecticut house, “which has never been occupied,” and the “completely wasted expense” of Bellosguardo, which she had not visited in more than forty years. He urged her to sell all of her properties. She also had expenses for the storage of dresses at Bonwit Teller and an automobile stored out in Westchester County, which she no longer called a driver for. As Wallace put it, “None of these expenses benefit you in any way.”

She went right on spending, soon drawing up plans for an $87,000 teahouse to be made by the artist in Japan and giving him, over a period of five years, gifts totaling $290,000.

Huguette had a fairy-tale checkbook, one that was refilled whenever it ran out of magic beans. She had beencareful with her checking accounts, well into her seventies, balancing her checkbook and marking a balance after each check. Theoverdrafts had started around 1985, when she was nearly eighty. She wasn’t out of money; she just didn’t bother to tell her attorney or accountant that she had written checks.

For the next twenty-five years: Huguette would write the checks. The bank would call the attorney to say the account was overdrawn. And the attorney would transfer in money from another account, $50,000 or $100,000 at a time, guessing blindly at how much she might spend in the next few weeks. Irving Kamsler, the certified public accountant that Wallace had brought on in 1979 to handle Huguette’s finances, said Huguette knew the value of money but thought the checks would be covered without her involvement. And they were. Although this arrangementtroubled her bankers, who had never met Huguette, they never charged her an overdraft free.

Huguette was not poor. She was never poor. But what worried Wallace was that she was starting to eat into her savings.

Most of her income came from dividends paid by blue chips, stocks in the solid cornerstones of American industry: AT&T, American Airlines, Conoco, Exxon, General Electric, General Motors, Gulf Oil, RCA, Texaco. Her smallest were shares in two of her father’s old companies, Tonopah Banking Corporation and Clark Holding Company, which were no longer paying dividends. She engaged in no tax shelters or other schemes, paying more than 40 percent of her income in federal taxes through most of the Carter and Reagan years. (Ronald Reagan’s Tax Reform Act of 1986, which cut income tax rates on the highest earners, saved Huguette about $1 million a year.) Her income had its ups and downs with the stock market, but it was generally increasing, as shown on her tax returns: $725,734 in 1975, $1,000,010 in 1979, $3,092,147 in 1981, $5,827,446 in 1987.

Her spending, however, was increasing even faster, even from a hospital bed. During the 1970s, she had given away only about $35,000 a year, much of that to Etienne’s family, but her generosity increased when Ninta Sandré went into the nursing home in 1987 and accelerated again when Huguette herself went into the hospital in 1991. By the mid-1990s, she was giving away nearly a million dollars a year.

Each spring, her money men chased after her, seeking the information needed to report her gifts to the IRS. As the giver, Huguette owed the gift tax. It was a puzzle. Her attorney and accountant knew every penny spent on her properties and medical care, because they paid those bills. But for her personal account, which she used for most of her gifts, they had only the check numbers and amounts as listed on her bank statements. Well into the 2000s, her money men didn’t know the names of the recipients, because only she received the canceled checks, and she refused to give them up.

• • •

For a banker’s daughter, Huguette was not much interested in investing her capital either. Summit Bank of New Jersey held millions for her in anuninvested account. For example, on February 4, 1997,Huguette’s balance in that account was

Weitere Kostenlose Bücher