![Empty Mansions]()

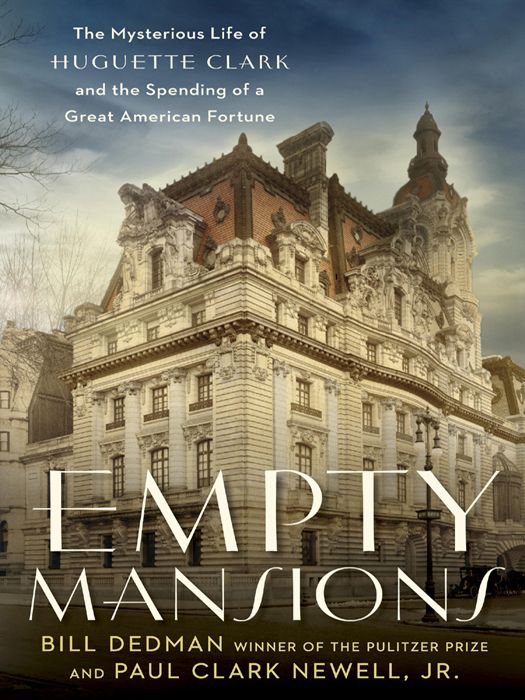

Empty Mansions

room, which the Corcoran now rents out to corporate clients at a rate of $25,000 per soirée.

In 1988, at age eighty-two, Huguette wrote to the mayor of Santa Barbara, Sheila Lodge. In her precise handwriting, she described how much she wanted to preserve Bellosguardo, the home her mother had built. “Dear Mayor Lodge, Your kind letter touched me deeply. It is most gratifying to me that you share my view on the beauty of Bellosguardo. My dear Mother put so much of herself into its charm and had the satisfaction of knowing that during the great depression, she was a bit helpful in giving much needed employment. I, in turn want to express to you, my grateful appreciation for the great help you are giving me in my endeavor to preserve Bellosguardo. With my sincere thanks to you. Huguette Clark.”

( illustration credit13.1 )

• • •

Both the family and the beneficiaries had reasons to settle. Rolling the dice at a trial can mean losing everything. Both sides had already spent a great deal on pretrial research and legal fees. And a trial would be an exhausting endeavor, expensive for everyone, lasting weeks or months.

Another reason to settle was that most of the key witnesses wouldn’t be able to testify to much at the trial. Through the “Dead Man’s Statute,” a quirk in New York law, beneficiaries of the will were barred from testifying about communications with Huguette. This law began with the common-law idea that a person with a financial interest shouldn’t be encouraged to commit perjury by testifying about what a dead man said before death. So a trial wouldn’t include much relevant testimony from Hadassah Peri or Chris Sattler or Dr. Singman. One option for attorney Bock and accountant Kamsler was to renounce their bequests, allowing them to fully testify in support of the will, though they would no longer stand to profit as beneficiaries. There was some doubt that a jury would let them inherit a dime anyway.

A final oddity in the negotiations was that the largest recipient in the will was not at the table. The family questioned whether the Bellosguardo Foundation was a genuine charity or just an excuse for Huguette’s attorney and accountant to rake in fees as trustees. As evidence of this claim, the relatives pointed to how little money the foundation would end up with—only about $4.7 million in cash, as the will was written, not nearly enough to maintain the great house. The counterclaim was simple: If it were a fraud, wouldn’t the attorney and accountant have put more money into it? The relatives also questioned how the foundation could be Huguette’s intent. “She didn’t have a charitable bone in her body,” several relatives said, ignoring or unaware of Huguette’s many years of donations to the Corcoran and to Beth Israel, her donation of Rancho Alegre to the Boy Scouts, her donation of theAndrée Clark Bird Refuge, and her quiet charity to friends and strangers.

Hoping to bolster the plan for the nascent Bellosguardo Foundation, a group of arts foundations in California stood up to say they would welcome, and perhaps support financially, the new neighbor. However, when the Santa Barbara groups tried to send a lawyer to the settlement talks in New York, the Clark family’s attorney, John Morken, refused to negotiate with him, saying if you love Bellosguardo that much, we’ll let you buy it after we win.

The family had a reason to insist that Bellosguardo be sold: That’s where most of the money was. As written, the will left 86 percent of the pot, after expenses and taxes, to charities, which don’t pay taxes. The Bellosguardo Foundation was a charity, as were the Corcoran and Beth Israel. For every $10 million that went to the relatives instead of the charities, about $4 million more in estate taxes would have to be paid. In other words, to get an inch, the relatives had to ask for a mile.

• • •

There was a strong reason for all sides to settle: It would ensure that the lawyers got paid.

If one of the aims of Huguette’s relatives was to keep the money out of the hands of her lawyers, their victory would nevertheless leave a large chunk of the estate in the hands of their own lawyer. Working on a contingency, as is standard, the family attorney would receive 33 percent of the first $50 million, and 30 percent of the next $50 million. At least sixty-two attorneys were named in court papers in this case, with dozens of others working behind the scenes, many

Weitere Kostenlose Bücher